All Categories

Featured

Table of Contents

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations (best term life insurance for 2025 agents). Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow.

There is no payment if the policy runs out prior to your death or you live beyond the policy term. You might have the ability to restore a term plan at expiry, however the premiums will certainly be recalculated based upon your age at the time of revival. Term life insurance policy is normally the the very least expensive life insurance policy available since it provides a survivor benefit for a restricted time and does not have a cash money value component like permanent insurance policy.

At age 50, the premium would increase to $67 a month. Term Life Insurance policy Rates 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Source: Quotacy. Quotes are for a $250,000 30-year term life policy, for males and ladies in exceptional wellness.

Interest prices, the financials of the insurance business, and state regulations can likewise affect premiums. When you think about the quantity of insurance coverage you can obtain for your premium bucks, term life insurance coverage often tends to be the least costly life insurance.

Thirty-year-old George desires to safeguard his family members in the not likely occasion of his early fatality. He acquires a 10-year, $500,000 term life insurance coverage plan with a costs of $50 per month. If George passes away within the 10-year term, the plan will pay George's recipient $500,000. If he passes away after the plan has expired, his beneficiary will get no benefit.

If George is diagnosed with a terminal health problem throughout the initial plan term, he possibly will not be eligible to restore the policy when it ends. Some policies supply assured re-insurability (without proof of insurability), but such functions come with a higher cost. There are a number of types of term life insurance policy.

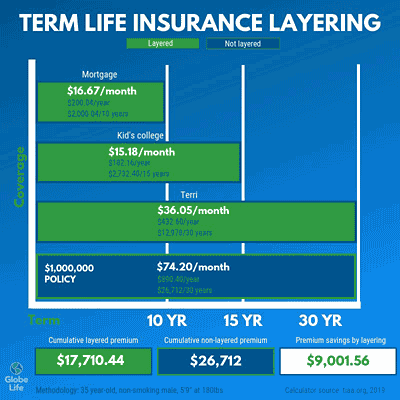

Usually, most business offer terms varying from 10 to three decades, although a few offer 35- and 40-year terms. Level-premium insurance has a set month-to-month settlement for the life of the policy. Most term life insurance policy has a level costs, and it's the kind we've been referring to in many of this write-up.

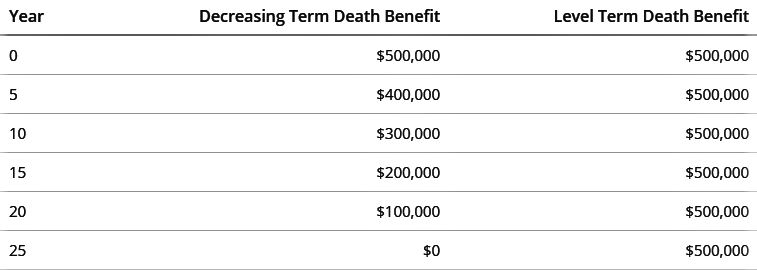

Coverage-Focused What Is Decreasing Term Life Insurance

Term life insurance policy is appealing to youngsters with youngsters. Moms and dads can obtain substantial protection for a reduced cost, and if the insured passes away while the plan is in impact, the family can count on the survivor benefit to replace lost revenue. These plans are likewise well-suited for people with expanding households.

Term life plans are ideal for people who desire significant coverage at a low expense. Individuals that possess entire life insurance pay more in premiums for much less insurance coverage yet have the safety of recognizing they are safeguarded for life.

The conversion rider must permit you to convert to any type of irreversible policy the insurance provider provides without constraints. The main attributes of the biker are keeping the original health and wellness rating of the term policy upon conversion (even if you later on have wellness issues or end up being uninsurable) and deciding when and just how much of the insurance coverage to convert.

Of training course, overall premiums will certainly boost dramatically since whole life insurance policy is much more pricey than term life insurance policy. Clinical problems that establish throughout the term life duration can not trigger costs to be enhanced.

Term life insurance policy is a relatively cost-effective method to offer a round figure to your dependents if something happens to you. It can be a great option if you are young and healthy and balanced and sustain a family. Whole life insurance policy features considerably greater regular monthly premiums. It is implied to provide protection for as long as you live.

Leading Term To 100 Life Insurance

It relies on their age. Insurance provider set a maximum age restriction for term life insurance coverage plans. This is generally 80 to 90 years of ages yet might be greater or reduced relying on the company. The premium likewise rises with age, so an individual aged 60 or 70 will certainly pay significantly even more than someone years younger.

Term life is somewhat similar to cars and truck insurance. It's statistically not likely that you'll need it, and the costs are cash away if you don't. Yet if the worst happens, your family will obtain the advantages.

The most popular type is currently 20-year term. Many business will not offer term insurance coverage to a candidate for a term that finishes previous his or her 80th birthday. If a policy is "eco-friendly," that suggests it proceeds effective for an extra term or terms, up to a defined age, even if the health of the insured (or other factors) would cause him or her to be turned down if he or she obtained a brand-new life insurance policy policy.

Premiums for 5-year renewable term can be level for 5 years, after that to a new price showing the brand-new age of the insured, and so on every 5 years. Some longer term plans will ensure that the costs will certainly not enhance throughout the term; others don't make that assurance, enabling the insurer to elevate the price during the plan's term.

This means that the policy's owner can alter it right into an irreversible kind of life insurance policy without extra proof of insurability. In a lot of kinds of term insurance coverage, consisting of home owners and auto insurance policy, if you haven't had a case under the policy by the time it expires, you obtain no reimbursement of the costs.

What Is Direct Term Life Insurance

Some term life insurance coverage consumers have been unhappy at this result, so some insurance providers have produced term life with a "return of premium" feature. level term life insurance. The costs for the insurance policy with this function are usually substantially more than for policies without it, and they typically call for that you maintain the policy effective to its term otherwise you waive the return of premium benefit

Degree term life insurance coverage costs and fatality benefits continue to be consistent throughout the policy term. Degree term life insurance coverage is normally extra affordable as it doesn't develop cash value.

Term Life Insurance For Couples

While the names frequently are made use of mutually, level term protection has some essential distinctions: the premium and death advantage remain the very same throughout of coverage. Level term is a life insurance coverage policy where the life insurance premium and survivor benefit continue to be the same throughout of insurance coverage.

Latest Posts

Expense Insurance

Senior Citizens Funeral Plan

Starting A Funeral Insurance Company