All Categories

Featured

Table of Contents

This is regardless of whether the guaranteed individual passes away on the day the policy starts or the day before the plan finishes. A degree term life insurance coverage plan can fit a wide range of conditions and demands.

Your life insurance coverage plan can likewise develop component of your estate, so might be subject to Estate tax read a lot more regarding life insurance policy and tax obligation - Guaranteed level term life insurance. Let's look at some features of Life Insurance from Legal & General: Minimum age 18 Optimum age 77 (Life insurance policy), or 67 (with Critical Disease Cover)

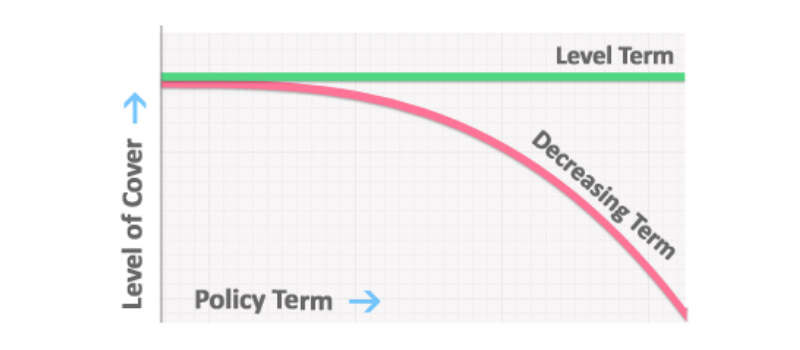

The quantity you pay remains the very same, but the level of cover lowers roughly in line with the method a repayment home mortgage reduces. Reducing life insurance can help your liked ones remain in the family members home and stay clear of any type of additional disruption if you were to pass away.

If you select level term life insurance policy, you can allocate your premiums due to the fact that they'll stay the exact same throughout your term. Plus, you'll recognize specifically just how much of a survivor benefit your beneficiaries will certainly receive if you pass away, as this amount will not transform either. The prices for degree term life insurance policy will rely on numerous elements, like your age, wellness status, and the insurance policy firm you pick.

When you go via the application and medical test, the life insurance company will assess your application. Upon approval, you can pay your first premium and sign any kind of pertinent paperwork to guarantee you're covered.

What is Short Term Life Insurance? A Guide for Families?

Aflac's term life insurance is practical. You can choose a 10, 20, or three decades term and appreciate the added comfort you deserve. Collaborating with an agent can assist you find a plan that works ideal for your needs. Discover more and obtain a quote today!.

As you search for methods to protect your economic future, you have actually likely come throughout a wide selection of life insurance policy options. Choosing the ideal coverage is a big choice. You wish to discover something that will certainly assist sustain your loved ones or the causes important to you if something takes place to you.

What is Term Life Insurance For Seniors Coverage Like?

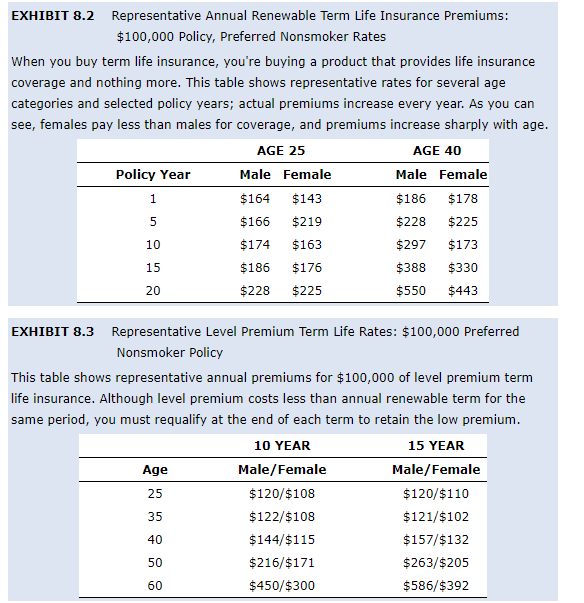

Many individuals lean toward term life insurance coverage for its simplicity and cost-effectiveness. Term insurance policy contracts are for a fairly brief, defined duration of time however have alternatives you can customize to your needs. Certain advantage choices can make your premiums change gradually. Level term insurance, nevertheless, is a type of term life insurance policy that has regular payments and an imperishable.

Degree term life insurance policy is a subset of It's called "degree" because your premiums and the advantage to be paid to your loved ones stay the very same throughout the contract. You will not see any modifications in expense or be left questioning its value. Some agreements, such as each year sustainable term, may be structured with costs that increase in time as the insured ages.

They're determined at the begin and remain the exact same. Having constant repayments can assist you far better strategy and spending plan since they'll never transform. Dealt with survivor benefit. This is likewise evaluated the beginning, so you can recognize precisely what survivor benefit quantity your can expect when you die, as long as you're covered and current on premiums.

Life insurance is more than just a policy; it’s a vital tool for protecting your loved ones and securing their financial future. Whether you’re looking for term life insurance to cover immediate needs or whole life insurance for lifelong security, the right policy offers peace of mind during life’s uncertainties. final expense insurance for funeral costs with brokers. Affordable options include universal life insurance, which combines flexibility with investment opportunities, or final expense insurance, designed to cover funeral costs and related expenses

For homeowners, mortgage protection life insurance provides added security, ensuring your family can keep their home in case of unexpected events. Accidental death insurance is another valuable option, offering coverage tailored to specific circumstances. Many policies now come with living benefits, allowing policyholders to access funds in cases of critical illness or other emergencies, adding another layer of financial support.

Life insurance adapts to your goals, whether you’re planning for retirement, saving for college, or ensuring your business is protected with key person insurance. Speak with a licensed insurance agent today to discover flexible options that align with your family or business needs. Request a free quote now and take the first step toward a secure tomorrow.

You concur to a fixed costs and fatality benefit for the duration of the term. If you pass away while covered, your death advantage will be paid out to liked ones (as long as your premiums are up to date).

What is Annual Renewable Term Life Insurance? Quick Overview

You may have the choice to for one more term or, more probable, restore it year to year. If your contract has actually an assured renewability condition, you may not require to have a brand-new medical examination to maintain your protection going. Your premiums are most likely to increase since they'll be based on your age at renewal time.

With this choice, you can that will last the remainder of your life. In this instance, once more, you may not need to have any type of new clinical tests, however costs likely will increase because of your age and brand-new protection (Term Life Insurance). Different firms provide numerous options for conversion, make certain to comprehend your options before taking this step

Talking with a monetary advisor additionally may assist you determine the path that aligns ideal with your total strategy. Many term life insurance policy is level term for the period of the contract period, but not all. Some term insurance may feature a costs that rises with time. With decreasing term life insurance policy, your fatality benefit drops gradually (this kind is usually gotten to specifically cover a long-term financial debt you're settling).

And if you're established for renewable term life, then your costs likely will increase every year. If you're checking out term life insurance coverage and wish to ensure straightforward and predictable financial protection for your family members, degree term might be something to think about. As with any kind of kind of protection, it might have some restrictions that don't meet your demands.

Why You Need to Understand Term Life Insurance

Generally, term life insurance policy is much more cost effective than irreversible coverage, so it's a cost-effective way to secure financial protection. Adaptability. At the end of your agreement's term, you have multiple options to proceed or go on from protection, commonly without requiring a clinical test. If your budget or insurance coverage needs change, survivor benefit can be minimized in time and lead to a reduced premium.

Just like other sort of term life insurance, as soon as the agreement ends, you'll likely pay higher premiums for insurance coverage due to the fact that it will recalculate at your present age and wellness. Repaired coverage. Level term uses predictability. If your financial situation modifications, you may not have the essential coverage and could have to acquire additional insurance policy.

That doesn't indicate it's a fit for every person. As you're going shopping for life insurance policy, below are a few vital elements to think about: Budget. Among the advantages of degree term protection is you know the cost and the fatality benefit upfront, making it easier to without fretting about boosts over time

Age and health and wellness. Typically, with life insurance coverage, the healthier and more youthful you are, the even more inexpensive the protection. If you're young and healthy, it might be an attractive choice to secure in low premiums currently. Financial duty. Your dependents and monetary responsibility contribute in determining your insurance coverage. If you have a young household, for example, level term can assist offer financial backing throughout critical years without paying for coverage longer than essential.

Latest Posts

Expense Insurance

Senior Citizens Funeral Plan

Starting A Funeral Insurance Company