All Categories

Featured

It permits you to spending plan and prepare for the future. You can quickly factor your life insurance policy right into your budget plan because the costs never alter. You can prepare for the future equally as easily due to the fact that you know exactly how much cash your liked ones will obtain in the occasion of your absence.

This is real for individuals who gave up smoking or that have a wellness problem that deals with. In these cases, you'll generally have to go through a new application procedure to get a far better price. If you still need protection by the time your level term life policy nears the expiration date, you have a couple of alternatives.

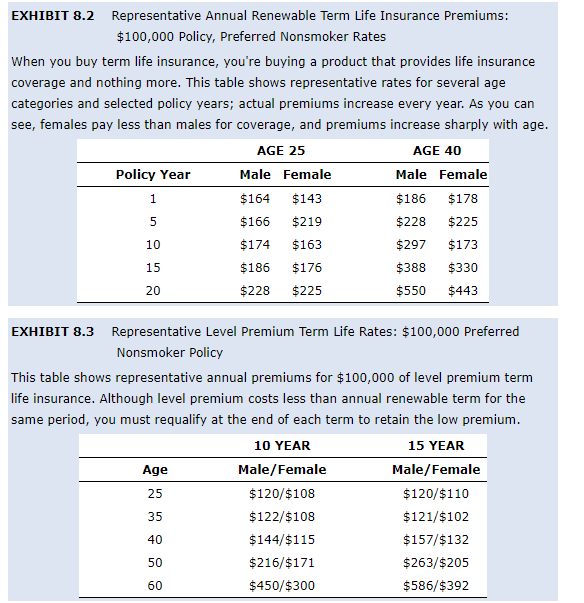

Most degree term life insurance policies come with the alternative to restore protection on a yearly basis after the initial term ends. level term life insurance definition. The expense of your plan will be based on your present age and it'll enhance each year. This could be a great choice if you only require to prolong your insurance coverage for 1 or 2 years otherwise, it can obtain expensive pretty promptly

Level term life insurance policy is among the cheapest coverage choices on the market due to the fact that it offers standard protection in the form of survivor benefit and just lasts for a set amount of time. At the end of the term, it expires. Whole life insurance policy, on the other hand, is considerably more pricey than level term life since it does not run out and includes a cash money worth feature.

Proven Voluntary Term Life Insurance

Rates may vary by insurance company, term, coverage amount, health and wellness course, and state. Not all plans are available in all states. Rate picture legitimate as of 10/01/2024. Degree term is a fantastic life insurance policy option for most individuals, yet depending upon your protection demands and individual situation, it could not be the most effective suitable for you.

Yearly eco-friendly term life insurance policy has a term of just one year and can be restored each year. Annual sustainable term life costs are at first reduced than level term life costs, yet prices go up each time you restore. This can be a great option if you, for instance, have just stop smoking cigarettes and need to wait two or 3 years to look for a level term plan and be eligible for a lower rate.

Innovative Term 100 Life Insurance

With a reducing term life plan, your fatality advantage payment will reduce in time, however your settlements will remain the same. Lowering term life policies like home mortgage defense insurance coverage normally pay to your loan provider, so if you're seeking a policy that will certainly pay out to your enjoyed ones, this is not a great suitable for you.

Raising term life insurance policy plans can help you hedge against rising cost of living or strategy economically for future kids. On the other hand, you'll pay even more ahead of time for less insurance coverage with an increasing term life plan than with a level term life plan. If you're not exactly sure which kind of policy is best for you, functioning with an independent broker can aid.

When you've made a decision that degree term is best for you, the following step is to buy your plan. Right here's how to do it. Determine just how much life insurance policy you require Your coverage quantity need to offer for your household's long-term financial demands, consisting of the loss of your earnings in case of your fatality, as well as debts and everyday costs.

A degree premium term life insurance policy strategy allows you stick to your budget while you aid secure your household. ___ Aon Insurance Solutions is the brand name for the broker agent and program management operations of Affinity Insurance coverage Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Agency, Inc. (CA 0795465); in OK, AIS Affinity Insurance Solutions Inc.; in CA, Aon Affinity Insurance Policy Providers, Inc.

The Plan Agent of the AICPA Insurance Coverage Depend On, Aon Insurance Coverage Solutions, is not connected with Prudential.

Latest Posts

Expense Insurance

Senior Citizens Funeral Plan

Starting A Funeral Insurance Company