All Categories

Featured

Table of Contents

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Life Insurance is a sort of life insurance policy policy that covers the insurance policy holder for a particular amount of time, which is recognized as the term. The term sizes differ according to what the individual chooses. Terms normally range from 10 to three decades and boost in 5-year increments, providing degree term insurance coverage.

They generally give a quantity of protection for much less than irreversible kinds of life insurance policy. Like any type of plan, term life insurance coverage has advantages and disadvantages relying on what will work best for you. The advantages of term life include affordability and the ability to personalize your term size and protection amount based upon your demands.

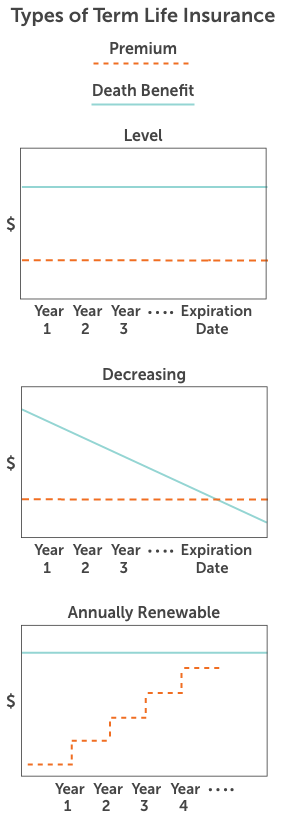

Depending on the kind of plan, term life can offer dealt with premiums for the entire term or life insurance coverage on degree terms. The fatality advantages can be repaired.

*** Rates mirror policies in the Preferred And also Rate Class problems by American General 5 Stars My representative was extremely educated and practical in the procedure. July 13, 2023 5 Stars I was pleased that all my needs were fulfilled without delay and properly by all the agents I spoke to.

What is Guaranteed Level Term Life Insurance? Comprehensive Guide

All documents was electronically completed with access to downloading for individual data upkeep. June 19, 2023 The endorsements/testimonials provided need to not be construed as a recommendation to acquire, or a sign of the value of any services or product. The endorsements are actual Corebridge Direct customers that are not connected with Corebridge Direct and were not supplied payment.

There are multiple kinds of term life insurance coverage policies. As opposed to covering you for your entire life expectancy like entire life or global life policies, term life insurance just covers you for an assigned amount of time. Plan terms normally range from 10 to three decades, although shorter and longer terms might be readily available.

If you want to maintain protection, a life insurer may use you the alternative to restore the plan for one more term. If you added a return of premium biker to your plan, you would receive some or all of the money you paid in premiums if you have outlived your term.

Degree term life insurance policy may be the most effective choice for those that want protection for a collection time period and desire their premiums to continue to be secure over the term. This might use to consumers concerned about the cost of life insurance and those who do not intend to alter their death advantage.

That is since term policies are not ensured to pay out, while long-term policies are, supplied all premiums are paid., where the death benefit reduces over time.

On the other hand, you might have the ability to secure a less costly life insurance policy rate if you open up the plan when you're more youthful. Comparable to innovative age, inadequate wellness can also make you a riskier (and extra costly) candidate permanently insurance coverage. If the condition is well-managed, you may still be able to discover cost effective insurance coverage.

How Does What Is Level Term Life Insurance Compare to Other Policies?

Wellness and age are usually much more impactful costs elements than sex., may lead you to pay even more for life insurance coverage. High-risk jobs, like window cleaning or tree cutting, may likewise drive up your price of life insurance.

The very first action is to determine what you require the plan for and what your spending plan is. When you have a great idea of what you desire, you may desire to contrast quotes and policy offerings from several business. Some companies offer on-line estimating for life insurance, but numerous need you to call a representative over the phone or personally.

Life insurance is more than just a policy; it’s a vital tool for protecting your loved ones and securing their financial future. Whether you’re looking for term life insurance to cover immediate needs or whole life insurance for lifelong security, the right policy offers peace of mind during life’s uncertainties. life insurance with living benefits brokers. Affordable options include universal life insurance, which combines flexibility with investment opportunities, or final expense insurance, designed to cover funeral costs and related expenses

For homeowners, mortgage protection life insurance provides added security, ensuring your family can keep their home in case of unexpected events. Accidental death insurance is another valuable option, offering coverage tailored to specific circumstances. Many policies now come with living benefits, allowing policyholders to access funds in cases of critical illness or other emergencies, adding another layer of financial support.

Life insurance adapts to your goals, whether you’re planning for retirement, saving for college, or ensuring your business is protected with key person insurance. Speak with a licensed insurance agent today to discover flexible options that align with your family or business needs. Request a free quote now and take the first step toward a secure tomorrow.

1Term life insurance coverage supplies temporary defense for a crucial duration of time and is generally cheaper than long-term life insurance policy. 2Term conversion standards and limitations, such as timing, may apply; for example, there might be a ten-year conversion benefit for some products and a five-year conversion advantage for others.

3Rider Insured's Paid-Up Insurance coverage Acquisition Alternative in New York City. 4Not offered in every state. There is a price to exercise this motorcyclist. Products and motorcyclists are offered in approved territories and names and attributes might vary. 5Dividends are not guaranteed. Not all getting involved plan owners are qualified for returns. For select bikers, the condition relates to the insured.

Our term life options include 10, 15, 20, 25, 30, 35, and 40-year policies. The most prominent type is level term, meaning your repayment (costs) and payout (survivor benefit) remains degree, or the very same, up until the end of the term duration. Level term life insurance policy. This is one of the most simple of life insurance policy alternatives and requires really little upkeep for policy owners

For example, you could offer 50% to your spouse and split the remainder amongst your adult kids, a parent, a buddy, or even a charity. * In some instances the fatality advantage may not be tax-free, find out when life insurance policy is taxable.

What is Term Life Insurance Level Term? A Beginner's Guide

There is no payout if the plan expires prior to your death or you live past the policy term. You may be able to restore a term plan at expiry, however the costs will be recalculated based upon your age at the time of renewal. Term life insurance is generally the least costly life insurance policy offered due to the fact that it uses a fatality benefit for a restricted time and does not have a money value component like irreversible insurance policy - What does level term life insurance mean.

At age 50, the premium would certainly increase to $67 a month. Term Life Insurance Fees 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Resource: Quotacy. Quotes are for a $250,000 30-year term life plan, for men and ladies in outstanding health and wellness.

The reduced risk is one factor that allows insurers to charge lower premiums. Rate of interest, the financials of the insurance provider, and state laws can additionally impact costs. As a whole, firms usually supply far better rates at the "breakpoint" coverage degrees of $100,000, $250,000, $500,000, and $1,000,000. When you think about the amount of protection you can get for your premium bucks, term life insurance policy tends to be the least expensive life insurance policy.

Latest Posts

Expense Insurance

Senior Citizens Funeral Plan

Starting A Funeral Insurance Company