All Categories

Featured

Table of Contents

nfinite banking is a financial strategy that empowers you to take control of your finances using the cash value of a whole life insurance policy. By becoming your own banker, you can leverage the cash value to fund large expenses, invest in business opportunities, or handle emergencies—all while your money continues to grow tax-free. For business owners, infinite banking is an invaluable tool for maintaining financial independence and flexibility.

Whole life insurance policies designed for infinite banking offer stability and predictability, ensuring steady cash value growth over time. life insurance with tax benefits through brokers. Policies with living benefits further enhance their appeal, offering access to funds for critical illnesses or other urgent needs. Whether you’re looking to finance major purchases, grow your business, or achieve financial independence, infinite banking adapts to your goals while providing long-term security

This concept is especially beneficial for individuals and families seeking flexible financial solutions or business owners aiming to optimize their cash flow. Learn more about how infinite banking can transform your financial future. Schedule a free consultation today and take the first step toward achieving complete financial control.

It enables you to budget and plan for the future. You can conveniently factor your life insurance policy into your budget plan due to the fact that the costs never change. You can prepare for the future equally as quickly because you recognize exactly just how much money your enjoyed ones will certainly obtain in the occasion of your absence.

In these instances, you'll typically have to go via a new application procedure to get a far better rate. If you still need protection by the time your level term life policy nears the expiration day, you have a couple of options.

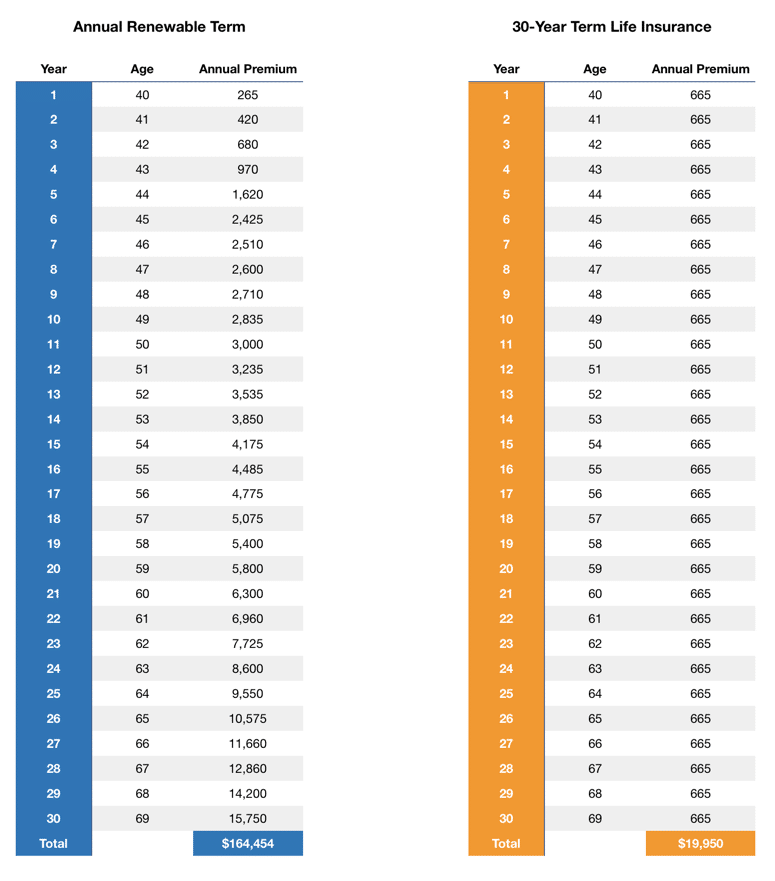

A lot of level term life insurance plans come with the alternative to renew coverage on a yearly basis after the first term ends. what is decreasing term life insurance. The cost of your plan will be based on your current age and it'll boost every year. This could be a great choice if you just need to extend your protection for 1 or 2 years otherwise, it can obtain pricey quite rapidly

Degree term life insurance policy is one of the cheapest protection options on the marketplace because it uses basic security in the type of survivor benefit and just lasts for a set amount of time. At the end of the term, it ends. Entire life insurance policy, on the other hand, is significantly a lot more pricey than level term life due to the fact that it does not expire and includes a money value feature.

Direct Term Life Insurance Meaning

Rates might vary by insurer, term, coverage quantity, wellness course, and state. Not all policies are offered in all states. Price illustration legitimate as of 10/01/2024. Level term is a terrific life insurance policy choice for many people, yet depending on your coverage requirements and individual circumstance, it might not be the very best fit for you.

Annual eco-friendly term life insurance policy has a regard to just one year and can be restored every year. Yearly sustainable term life premiums are at first less than degree term life premiums, yet prices rise each time you restore. This can be a good choice if you, as an example, have just quit smoking cigarettes and need to wait two or three years to look for a degree term policy and be qualified for a lower rate.

Cost-Effective Increasing Term Life Insurance

, your fatality advantage payout will decrease over time, but your repayments will certainly stay the same. On the various other hand, you'll pay even more ahead of time for much less protection with an increasing term life plan than with a degree term life policy. If you're not sure which kind of policy is best for you, functioning with an independent broker can aid.

Once you have actually determined that degree term is right for you, the following action is to acquire your policy. Right here's exactly how to do it. Determine just how much life insurance policy you require Your insurance coverage quantity should offer your household's long-term financial demands, including the loss of your income in case of your death, in addition to financial debts and daily expenses.

A degree costs term life insurance plan allows you stick to your budget while you assist secure your household. ___ Aon Insurance Services is the brand name for the broker agent and program management procedures of Affinity Insurance policy Services, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Company, Inc. (CA 0795465); in Okay, AIS Fondness Insurance Providers Inc.; in CA, Aon Fondness Insurance Policy Solutions, Inc.

The Strategy Agent of the AICPA Insurance Coverage Depend On, Aon Insurance Coverage Solutions, is not affiliated with Prudential.

Latest Posts

Expense Insurance

Senior Citizens Funeral Plan

Starting A Funeral Insurance Company